How Do Gold Prices Change Throughout the World?

Gold prices don’t follow a single, worldwide standard, but vary in markets from Dubai and New York to Singapore. This creates opportunities for smart money moves if you know how regional economies and local factors affect values. Whether you’re buying a wedding band in Mumbai, trading gold paper in Chicago, or cashing in family jewelry in London, you need to be aware of these differences, because the cost of that same gold ounce might be significantly different depending on where and when you buy or sell.

The Foundation of Gold Pricing Mechanisms

The London Bullion Market Association (LBMA) sets global gold prices twice daily in U.K. time at 10:30 a.m. and 3 p.m. through electronic auctions. Major banks such as JPMorgan Chase, HSBC, and Standard Chartered are among the key institutions active in the London bullion market, which has annual trading volumes in the trillions of dollars.

The Commodity Exchange Inc. (COMEX) in New York trades up to 27 million gold ounces daily and has almost 24/7 accessibility, with a significant volume of trade occurring during Asian hours. Less than 1% of contracts result in physical delivery, as most trading sets prices rather than moves actual metal. Standard contracts cover 100 troy ounces, with 1-ounce contracts available for retail traders.

A troy ounce equals 31.1034768 grams, which is roughly 10% more than a regular ounce. Gold futures trade at many times the SPDR gold exchange-traded fund (ETF) volume daily, showing how “paper gold” markets dwarf physical trading.

Currency Exchange Rate Effects on Local Gold Prices

Local gold prices increase and fall partly because of how a currency competes with the U.S. dollar. Since world markets price gold in dollars, the relationship between dollar strength and gold shows a negative correlation of about -0.82 with real interest rates. When the dollar strengthens, gold costs more for buyers using other currencies. When the dollar weakens, gold becomes cheaper for international buyers.

Comparing gold with the U.S. Dollar Index clarifies this link, with correlations often in the -0.4 to -0.8 range depending on market conditions. A strong dollar typically pushes gold prices down, while a weak dollar drives them up, as buyers from other countries react to what looks like a bargain.

Banks have noticed this shift and continue buying gold. In early 2025, central banks added hundreds of metric tons, exceeding the five-year average.

Regional Gold Market Characteristics and Price Variations

China and India account for more than 50% of global gold demand, with China at 1,100 metric tons (26%) and India at 1,050 metric tons (25%) in 2024. China focuses on investment (bars, coins, ETFs) to reduce its dependence on the U.S. dollar, while India concentrates on jewelry for weddings and festivals. North America accounted for nearly 90 metric tons of gold ETF inflows in September 2025, which is more than 60% of global ETF purchases.

Tax and regulatory variations also create arbitrage opportunities. India imposes customs duties and goods and services tax, allowing male travelers 20 grams or females 40 grams duty-free, with excess amounts subject to substantial customs duties. The UAE charges 5% value-added tax (VAT) on gold in major retail markets. Singapore offers zero capital gains tax on precious metals with world-class storage.

Key Economic Factors Driving Global Price Changes

Central banks globally added 1,045 metric tons in 2024, extending their buying streak to 15 consecutive years. Poland (90t), Turkey (75t), India (73t), and China (44t) were the main buyers, highlighting diversification from the dollar by emerging markets.

The Federal Funds Rate was at 4% to 4.25% in October 2025, down from a peak of 5.25% to 5.50% in July 2023. Despite elevated rates, gold rose over 50% in 2025, exceeding $4,100 per ounce in October, emphasizing how other factors can override traditional rate-gold relationships.

Inflation in April 2025 reached 2.5%, above the Fed’s 2% target, while core personal consumption expenditures inflation held steady at 2.7% in August 2025, indicating persistent inflationary pressures. Global gold mining production in 2024 was 3,300 metric tons, with recycling contributing about 1,370 metric tons, or 27.5% of total supply. A limited supply, central bank buying, and persistent inflation support prices globally.

Modern Factors Reshaping Gold Price Movements

Gold ETFs have democratized access for investors. SPDR Gold Shares holds approximately 1,050 metric tons worth $138 billion, with global ETF inflows extending to 397 metric tons after the first half of 2025. Gold futures offer no management fees, unlike ETFs, while the margin requirements are 80% lower than other metals.

Bitcoin’s correlation with gold prices fluctuates. From November 2022 to November 2024, gold increased 67% while Bitcoin rose nearly 400%. By March 2025, gold gained 16% while Bitcoin dropped over 6%.

Algorithmic trading dominates gold futures, creating new patterns of volatility. COMEX and LBMA spreads vary widely, recently reaching $60-$80 per ounce, with bid-ask spreads of $0.50 to $2 for spot delivery. Geopolitical tensions increasingly override traditional correlations, with gold gaining 28% during stress periods in 2024. While 295 million people own Bitcoin globally, gold ownership remains higher, demonstrating physical gold’s enduring cultural appeal.

Smart Strategies for Gold Transactions in a Global Market

Timing matters when buying gold across borders. Prices often dip in the first half of the year, while June to July record higher prices during wedding seasons. Following the holidays, January and February typically experience a weaker demand for jewelry. Experts suggest dollar cost averaging, which involves buying small amounts of gold regularly rather than trying to guess a perfect time to purchase. This helps smooth out the wild swings caused by currency shifts and world events.

Local markups and tax rules can save you significant amounts of money when buying in different countries. Jewelry carries extra manufacturing charges of 5% to 20% on top of the gold price, while bars and coins align more closely with market rates. Dubai charges 5% VAT and hosts one of the world’s largest gold markets. Singapore offers zero capital gains tax and world-class storage. Hong Kong maintains a zero sales tax and competitive prices. These differences create advantages for international buyers willing to travel or work with dealers who have a global reach.

Market forecasts point to a strong potential upside that makes location and timing crucial. JPMorgan forecasts gold hitting $4,000 per ounce by mid-2026, while Goldman Sachs targets $3,700 for late 2025. Some analysts note gold has already touched $4,300 to $4,365 in 2025, a gain of up to 66% this year alone.

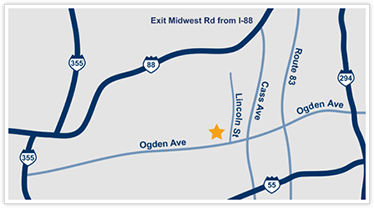

Partner With Gold Experts in Westmont, Illinois

To benefit from the opportunities in global gold markets, working with professionals who understand international pricing, currency relationships, and regional access makes all the difference. That’s what we provide at Americash Jewelry & Coin Buyers, where our team will help you navigate global gold complexities to make smarter buying and selling moves.

Tags: Gold Prices, Worldwide