Should You Put Your Money in Gold and Silver Instead of a Bank?

When investing and protecting one’s money, many often ask whether one should convert cash in a bank account into physical assets, including precious metals such as gold and silver. Low-interest rates that haven’t been unable to keep pace with inflation and the increased risk associated with banks raise the question: should I buy gold or leave my money in the bank? Let’s take a look a the issue in more detail.

Why Invest in Gold or Silver?

Gold is a tangible asset with an established value that constantly rises. For many people and institutions, it serves as a reliable investment. Due to its rarity and the gradual dwindling of global mining reserves, gold has become a globally recognized and tangible form of wealth. Physical gold, whether in an official capacity in a vault or on your premises, is a means to withdraw your money from circulation, preserving it into a commodity that you can expect to increase in value.

Furthermore, in the case of a bank failure and the resulting economic fallout, gold’s value as a haven investment would undoubtedly rise due to increased demand. Finally, one of the biggest appeals of gold is liquidity, whereby you can convert many precious metal assets to cash within days or even hours. All these benefits also apply to silver.

Deciding Factors for Putting Your Money in Gold and Silver

Several variables might impact the choice to invest in gold and sterling silver rather than storing money in a bank. People may seek safe-haven assets when they experience economic instability and worry about the soundness of the financial system. During times of financial crisis or inflation, many view gold and silver as a store of value that won’t fluctuate or decline. Thus, many decide to put their money into precious metals to hedge against inflation.

Another crucial benefit when you buy gold and silver is diversification. Compared to keeping all your spare cash in a bank, investing in gold and silver will diversify your investment portfolio beyond typical financial assets, such as equities and bonds, lowering your risk from asset losses.

But the most critical factor in deciding whether to buy gold and silver is your confidence in the stability or solvency of banks. The decision is usually driven by a person’s perception of risk, investment goals, and their evaluation of the current economy. Another factor may be getting access to a good deal on silver and gold items, giving your cash more conversion power. Some even value precious metals for their tangibility and historical relevance.

How Can You Protect Your Money From a Bank Failure?

Protecting your money after bank failures or financial crises necessitates careful planning and preventive measures. Here are some ideas to help shield your money.

Diversify Your Holdings

Spreading your money across many types of assets will limit your exposure to the effects of a particular institution or industry. To avoid putting all your eggs in one basket, consider investing in various asset classes, such as equities, bonds, real estate, precious metals, and cash. This ensures you won’t lose all your money in the case of a bank failure.

Maintain Adequate Insurance Coverage

You may want to insure your bank holdings with a deposit insurance plan established by your local government or regulatory agencies. Moreover, it’s vital that you understand the degree of protection available to you by learning more about the coverage limits and conditions of the policy.

Look Into Multiple Banks and Financial Institutions

Instead of putting all your money in one place, you should spread it across many respectable financial organizations. This method can spread your risk and boost your chances of keeping access to your cash even if one bank fails. Keep current on the financial health of the banks with whom you have accounts. Examine the bank’s financial statements, credit agency ratings, and relevant news or reports.

Look at alternatives to established banks. Credit unions, for example, are member-owned financial cooperatives that may provide competitive rates while emphasizing member satisfaction. Digital banks or financial technology businesses may also have unique investment services to offer.

Keep Physical Cash

While storing all your money in cash isn’t recommended, keeping a fair quantity of real currency on hand might be useful in the event of a bank’s failure or financial disruption. So ensure that you have enough cash on hand to meet any urgent needs and interruptions to electronic payment systems.

Seek Professional Advice

Speak with a reputable financial adviser who can give personalized advice based on your unique situation and current economic conditions. During difficult times, they can assist you in navigating the complexity of financial planning, risk management, and asset allocation.

Remember that preserving your money will require a detailed, balanced strategy. While protection and hedging against losses are necessary, finding a balance that coincides with your financial growth goals and risk tolerance is also important.

Buy Gold and Silver and Rest Easy

With inflation rampant and the possibility of bank failures, keeping money safe is a common concern. Liquidity is essential for investors who wish to manage a portfolio and swiftly switch in and out of assets when opportunities emerge. While gold doesn’t pay interest like cash in a bank, it has kept its worth for several centuries, growing with the price of commodities and occasionally storming ahead in times of uncertainty and instability. What’s more, it’s a liquid asset that you can change into cash in a matter of minutes.

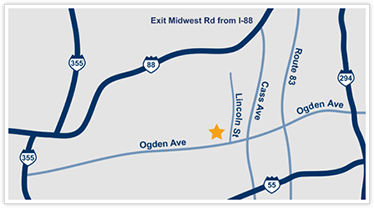

Buy and Sell Gold and Silver, Coins, Watches, and Jewelry in Westmont

While you can’t use objects such as gold rings and silver necklaces as you do cash, they can be a solid part of your investment strategy. Email or contact us by your preferred method to chat with Americash Jewelry & Coin Buyer about your needs. We’ll gladly explain how to invest money in precious goods and materials more effectively. We can also provide you with the best options for converting cash into gold and reaping the previously outlined benefits.

gold and silver round coins by Zlaťáky.cz is licensed with Unsplash License