Is There a Tax on Selling Gold and Silver in Illinois?

Gold and silver can be a solid investment for any portfolio. Still, before you buy or sell these precious metals, you must know what you’re getting into. When you sell your gold and silver, you may have to pay taxes to the state or federal government or both. Knowing the amount you’ll pay in taxes can help you determine your actual gains or losses for selling silver and gold. This guide will help you learn everything you need to know about how the state of Illinois taxes gold and silver sales.

Does Illinois Have a Tax on Selling Gold and Silver?

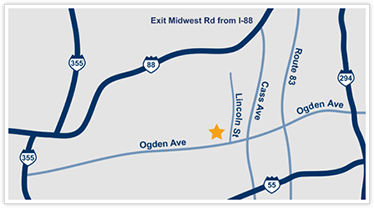

When you buy items in Illinois, you must usually pay sales and use tax. However, the tax situation can get complicated when selling precious metals. Certain gold and silver items may be exempt from taxes, while others may not be. To better understand the taxes you may owe, consult with someone at our Americash Jewelry & Coin Buyers store.

What Are the Taxes Associated With Selling Silver?

Illinois has a 6.25% sales tax, with an additional 1% to 3.75% in some counties and municipalities. So, when you buy silver, you may have to pay this rate if you purchase certain items. Fortunately, the tax exemption for silver is broad, allowing you to avoid paying sales tax on silver legal tender such as currency and coins.

What Are the Taxes Associated With Selling Gold?

In Illinois, the taxes on gold sales are the same as those on silver sales. Generally, you won’t have to pay taxes on gold items, except for some instances. However, some gold items are subject to an occupation tax, which is charged based on the rate for the county and municipality where they’re sold, with 6.25% being the minimum.

What Gold and Silver Items Does Illinois Tax?

Certain gold and silver items require you to pay taxes if you sell them in Illinois:

- Bullion: Illinois collects taxes on gold and silver with a purity of not less than 980 parts per 1,000 when it’s in its bulk state.

- Accessories: If you sell accessories such as gold or silver coin flips, apparel, or decor, you will pay a tax in Illinois.

- Processed items: Any items made by a third party that are worth more than their precious metal content, such as statues, require you to pay taxes in Illinois when you sell them.

Does Illinois Have a Tax on Bullion Made From Gold or Silver?

Not all gold and silver bullion sales in Illinois are subject to taxes. If you sell legal tender, currency, coins, bullion, or medallions made from a precious metal, including silver or gold, you are exempt from paying taxes on the sale amount, according to Illinois state law. Illinois only taxes the South African Krugerrand. Coins must meet the purity requirement to qualify for tax exemption under this law.

Is There a Capital Gains Tax When Selling Gold and Silver?

When you sell your silver and gold, any profits you make over the original purchase price will be subject to capital gains tax because the metals are considered collectibles. The tax rate for selling silver and gold is the same as your income tax rate in Illinois. Here are details about capital gains taxes on silver and gold.

What Is the Capital Gains Tax on Silver?

If you hold your silver for a year or less and sell it for a profit, you’ll pay your normal income tax rate on those short-term capital gains. You’ll pay 28% in long-term capital gains when holding your silver for over a year. Short-term capital gains won’t be taxed more than 28% regardless of your income, as this is the maximum tax the government can collect on capital gains from selling collectibles.

What Is the Capital Gains Tax on Gold?

As with silver, selling gold comes with a capital gains tax. If you hold gold for a year or less, The state taxes it as ordinary income. This means you pay your normal income tax rate on the short-term gains. Selling your gold after a year or longer comes with the same 28% long-term capital gains rate as silver.

Is It Possible To Avoid Paying Tax When Selling Silver and Gold?

You might be able to avoid paying taxes when you sell gold and silver if you aren’t receiving any capital gains on the profits from the sale. A 1031 exchange is the best way to defer the capital gains tax on a gold or silver transaction. This tax strategy requires you to reinvest the capital gains from the sale back into gold or silver. You can’t take any portion of the profits, or you’ll have to pay the capital gains tax.

Selling gold or silver through a self-directed Roth IRA account is another way to avoid paying taxes. However, you must avoid touching the physical gold in the Roth account, leaving that portion in your portfolio to grow. The gold and silver don’t have a capital gains tax as long as they remain in the Roth account.

Gold and silver transactions under a certain amount may not be subject to a tax, and you don’t pay tax on silver and gold that doesn’t meet the purity level threshold. Ask our professionals if you have questions about whether your gold and silver sale will be subject to taxes.

Learn More About Selling Gold and Silver

When you’re ready to sell your gold or silver, whether it’s coins, jewelry, collectibles, or other unique items, contact our team. Our experts can help you understand more about selling gold and silver and how much you might pay in taxes. Of course, it’s always best to consult your tax or financial advisor before you make any major financial decisions. Let us walk you through the process of selling gold and silver so you get the best price for your items.

gold and black metal tool by Jingming Pan is licensed with Unsplash License