Should You Buy Physical Gold or Silver Instead of Digital Assets?

Diversity is important in any portfolio, which is why investors are constantly comparing one asset to another. Gold and silver have proven their value over millennia, while cryptocurrency has been around for less than 20 years. Understanding these wildly diverse investment options will help you understand where to put your money.

Ways To Invest in Gold and Silver

Precious metals such as gold and silver are available in many forms. You can choose to purchase physical products or other types of investments that are based on the value of these precious metals. These investments include:

- Bullion: Bullion refers to any form of gold or silver that’s pure or nearly pure.

- Coins: Gold and silver coins are minted by various governments, increasing the value of the metal by 1% to 10%.

- Exchange-traded funds and mutual funds: Many funds invest in gold and silver companies and bullion as part of their portfolios.

- Futures and options: These are contracts that agree to the future sale of precious metals.

- Jewelry: Owning fine items crafted from precious metals can be an enjoyable way to invest.

Ways To Invest in Digital Goods

Digital assets represent more than $1 trillion in market capitalization and utilize blockchain technology to record, validate, and store transactions across numerous computers around the globe. Blockchain technology is designed to offer enhanced transparency and decentralization, and blockchain transactions cannot be deleted or altered, which offers security and reliability to investors. Some types of digital assets include:

- Cryptocurrencies: Cryptocurrencies are decentralized digital funds based on blockchain.

- Non-fungible tokens (NFTs): NFTs are unique tokens that bestow ownership or partial ownership of a digital product such as a video or image.

- Security tokens: These are a digital asset that denotes ownership of an investment, just like a stock or bond.

- Stablecoins: Stablecoins are a type of cryptocurrency that’s tied in value to a stable reserve asset such as gold or another currency.

Value

Though there are a myriad of options for investing in cryptocurrencies and other digital assets, it’s not always clear where these products derive their value from. Cryptocurrency is a relatively recent phenomenon that was first introduced in 2009. Bitcoin was the first form of cryptocurrency to enter the market, but there are now several options to choose from, including Ethereum, Tether, BNB, XRP, USDC, Solana, and Cardano.

There’s no underlying entity that backs cryptocurrencies. The World Gold Council has speculated that Bitcoin’s value may respond primarily to speculative price momentum. However, the community of owners must agree on a particular value for the cryptocurrency to function.

It’s even trickier to determine where an NFT derives its value from. These tokens vary widely and may give you partial ownership of a digital image or video, access to an exclusive group, discounts on other purchases, or simply bragging rights for being an investor in a particular program. The value of an NFT is essentially whatever you and others believe it is. Thus, NFT markets can quickly gain traction or promptly fall flat.

Gold and silver derive their value from their scarcity. These precious metals have always been deemed valuable. Their use in coveted items such as jewelry, art, and artifacts correlates to the longstanding social construction that regards gold and silver as desirable products. Historically, gold has been the backup means of exchange should a currency collapse. The price of gold and silver is ultimately determined by the amount in federal reserves, the scarcity on the market, and the demand for these precious metals. The value of gold typically rises as the stock market falls.

Volatility

Gold is a stable investment with low volatility. Investors use gold to protect their portfolios from the more unpredictable fluctuations of the stock market. Gold has a very low correlation to financial markets, which are notoriously volatile. While the value of gold does fluctuate, wise investors can often assess current global conditions to develop an educated guess at how the value of gold will respond.

The price of gold tends to increase during times of geopolitical uncertainty. It also responds to issues around mining production and associated government policies. More efficient mining strategies can cause gold and silver prices to fall, while they will rise when these commodities are scarce.

Some investors see cryptocurrency as a form of digital gold. It’s true that digital assets have a very low correlation to financial markets and can thus hedge against risk much the same way as gold does. However, cryptocurrency has shown extreme volatility. The value of Bitcoin has been known to fall by 30% in a single day. A slight change in perception can cause the value of digital assets to skyrocket or plummet.

Bitcoin is more than four and a half times more volatile than gold, with a value-at-risk that’s nearly five times that of gold. While the price of gold and silver does fall, these precious metals have historically rebounded. Cryptocurrencies haven’t had enough time on the market to prove their reliability yet.

Reliability

Digital goods and cryptocurrencies are entirely dependent upon the internet. Unlikely though it may seem, a global internet blackout would eliminate all digital assets. There is no physical asset to back up digital goods. Even a local internet blackout would eliminate your ability to track or use cryptocurrency of any kind. In some countries, individuals can lose access to the internet as the result of government shutdowns. Furthermore, a University of California researcher speculated that solar storms could cause global internet outages for several months.

As a physical asset, gold is far more reliable. This is especially true if it’s in your personal possession. If the gold is stored elsewhere, you may face some complications physically obtaining it, but the fact remains that the gold does exist. If paper money no longer existed, it’s likely that society would fall back on assets such as gold for the exchange of goods and services. This is why many investors prefer to put their money into gold and silver rather than a bank.

Build Your Investment Portfolio

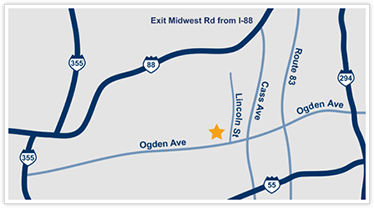

Gold and silver have numerous benefits over digital goods. While you may choose to diversify with a variety of assets, it’s important to have this time-tested staple in the mix. Contact us at Americash Jewelry & Coin Buyers in Westmont, Illinois, and we’ll help you start investing in gold and silver.