Gold vs. Silver vs. Platinum Investing Guide

Gold and precious metals are attracting strong interest in 2025, with gold prices surpassing $4,000 an ounce and silver prices having doubled since early 2023. A combination of economic anxiety, stubborn inflation, and aggressive central bank buying has ignited metals prices, making the gold vs. silver vs. platinum debate more relevant than ever. Our team at Americash has put together this guide to help you determine the best precious metals to invest in.

Understanding Precious Metals Investment in 2025: Market Landscape Overview

The booming metal market offers you an excellent opportunity to protect your savings against inflation. Central banks can’t seem to get enough gold, buying 1,197.11 tons in 2024 alone, the third consecutive year they’ve purchased over 1,000 tons. They’re currently buying about 782.65 tons quarterly, with yearly purchases expected to hit 992.08 tons.

Why is there such a gold rush? Countries are dumping traditional currencies as global tensions rise. Central banks now hold roughly 39,903.67 tons, or nearly 20% of their official reserves. This buying spree, plus growing industrial demand, has built a sturdy floor under prices for all three metals. Historical patterns indicate that metal prices often increase before economic storms hit. Gold demand climbed 3% to 1,376.79 tons in quarter two of 2025, while central banks added another 182.98 tons during that same quarter.

Gold: The Traditional Safe Haven

Gold remains the traditional safe haven, returning an average of 7.98% annually for five decades. During the 2008 economic crisis, it jumped 78% from $730 to $1,300, proving its worth when everything else tanked. Investment hunger for gold exchange-traded funds (ETF) shot up 170% from last year, pulling in 249.67 tons. So far this year, ETF inflows have hit 341.72 tons, or about 10% of global holdings.

You can invest through ETFs or physical gold. ETFs let you buy and sell instantly during market hours at prices that track the real thing. The trade-off is annual fees of 0.25% to 0.40%, which can gradually reduce your returns. Physical gold puts actual metal in your hands, which many people prefer during uncertain times. But you’ll need somewhere to keep it. Security systems can cost $2,000 to $5,000 upfront, plus monthly fees.

For serious collectors, storage becomes a big deal. Quality safes cost more than $5,000 and need specific ratings, such as a UL burglary rating TL-15 or TL-30, and fire protection for at least an hour at 1,700 degrees Fahrenheit. Insurance typically costs 1% to 2% of your collection’s value each year. Regular home policies usually cap coverage at $1,000 to $2,500. Total gold bar, coin, and ETF holdings grew 3% to about 54,454 tons, with physical gold having its strongest first half since 2013.

Silver: The Hybrid Metal

Silver has a unique dual role as both a precious and an industrial material, making it more volatile than gold. Its price swings average 28.8% compared with gold’s 16.2%. This creates opportunities and risks. For five consecutive years, demand has outstripped supply, with a current gap of 149 million ounces. Industry absorbs most silver production, with solar panels accounting for 19% of demand, or 232 million ounces annually. Industrial use hit a record 680.5 million ounces in 2024.

Silver’s prospects keep rising thanks to industrial demand. Solar panel demand could jump 170% by 2030 as clean energy takes hold. Electronics manufacturers can’t get enough of it, as silver conducts electricity better than anything else, making it crucial for smartphones and artificial intelligence hardware. However, only about 30% comes from dedicated silver mines, while the remaining 70% is just a byproduct from mining other metals. This creates supply issues that tend to push prices up.

Currently, silver trades around $38.59 per ounce, up 56.7% since January 2023. Last year, demand hit 1.16 billion ounces while supply was just 1.02 billion, and that gap won’t close anytime soon. Silver’s average price jumped 21% in 2024 to its highest point since 2012. So far this year, it’s up 28%, making it one of the hottest commodities you can buy.

Platinum: The Undervalued Opportunity

Some investors view platinum as undervalued relative to its scarcity. It’s 30 times rarer than gold but often costs less because it’s tied closely to the auto industry. But platinum’s heading for its third straight quarterly gain and has shot up nearly 80% this year. In the last four months, prices have jumped 55%, while gold has managed only a 16% rise since June.

On the supply side, South Africa digs out 70% of the world’s platinum from deep, expensive mines. In 2024, Africa produced about 80.3% of global platinum, with South Africa handling 89% of Africa’s output. This concentration creates a problem and an opportunity. South African mining faces constant challenges, such as power outages, worker strikes, and crumbling infrastructure. Russian exports have also dried up due to sanctions. Less supply usually means higher prices.

The future looks bright for platinum beyond jewelry and cars. The hydrogen fuel cell market is set to expand significantly from $5.23 billion to $8.19 billion this year, before rising to $47.9 billion by 2030. The catalyst market for these cells might grow from $0.53 billion last year to $1.37 billion by 2030. Platinum is at the heart of this technology. Last year, platinum averaged $925 an ounce, but by July 2025, it hit $1,474, which was a 60% increase from January’s $921 price. Production may drop 6.4% this year due to mining problems. Reduced production could place upward pressure on prices, though market conditions vary.

Making Your Precious Metals Investment Decision

So how much metal should you own? Most money professionals suggest putting 10% to 15% of your nest egg into precious metals.

If you’re over 55, you can play it safer at 5% to 10%, with 80% in gold, or 4% to 8% of your portfolio, and 20% in silver, 1% to 2%. If you’re between 35 and 55 years old, consider 7% to 12%, with 5% to 9% in gold and 2% to 3% in silver. If you’re under 35, you could opt for 10% to 15%, splitting it 6% to 10% gold, 3% to 5% silver, and 1% to 3% in platinum for extra growth potential.

The Internal Revenue Service treats physical metals as collectibles, which means you could face up to 28% tax on long-term gains. That’s higher than the 20% maximum you’d pay on stocks.

The Smart Approach To Investing

Dollar-cost averaging, which involves investing fixed amounts regularly regardless of price, is often considered a smart approach to investing. It smooths out wild price swings but might cost more in fees over time. Most investors do well with 60% to 70% gold and 30% to 40% silver in their metals allocation. Conservative types might prefer 70% gold for stability.

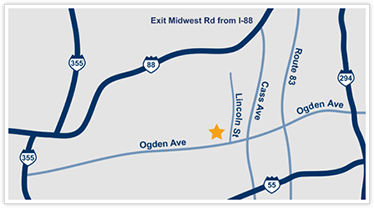

Are you in the Chicago area and want to learn more? Visit our showroom or our website for clear, reliable guidance. In today’s chaotic markets, having some shiny insurance might help you sleep better at night.

gold and silver round coins by Zlataky.cz is licensed with Unsplash License