Why Are Banks Buying So Much Gold?

Gold has been recognized as a form of currency since 550 BC. It’s circulated in numerous countries and is recognized worldwide for its intrinsic value. When the value of the United States dollar falls, and geopolitical uncertainties rise, the value of gold soars. This asset is used by individuals and governments alike to diversify investments. The current state of the global economy is ripe for gold investments, which is just what we’ve seen in many countries. Understanding the banks’ logic behind buying up gold might influence your own choices when it comes to managing your assets and investments.

An International Asset

Gold was once linked to international currency rates and was used to back the value of systems such as the dollar. The fixed currency system went out of use in 1973, but gold is still a valuable asset held by many countries worldwide. The United States is the largest holder of gold, with 8,133.53 metric tons as of the second quarter of 2023. This massive ownership is just 107.9 metric tons fewer than the next three countries combined.

Under the Bretton Woods Agreement, first negotiated in July 1944, the value of the United States dollar was determined by the value of gold, and other global currencies were pegged to the dollar. At this time, the United States agreed to exchange gold for the dollar. At one point, the United States reportedly held 90 to 95% of global gold reserves.

President Richard M. Nixon began devaluing the dollar relative to gold in 1971, as he was concerned that the gold reserves could no longer cover the number of dollars in circulation. This was followed by a temporary suspension on the dollar’s ability to convert to gold. The Bretton Woods system ultimately collapsed in 1973. With this system out of play, countries were free to negotiate the trade of gold at any value deemed appropriate.

The United States retains a massive amount of gold, with this precious metal accounting for 75% of its foreign reserves. The next-largest gold-holding countries are:

- Germany: 3,352.67 metric tons.

- Italy: 2,451.86 metric tons.

- France: 2,436.9 metric tons.

- Russian Federation: 2,329.65 metric tons.

- China: 2,113.48 metric tons.

- Switzerland: 1,040.01 metric tons.

- Japan: 845.98 metric tons.

- India: 797.44 metric tons.

- Turkey: 669.81 metric tons.

The International Monetary Fund (IMF) holds 2,814.1 metric tons of gold stored at several designated depositories due to its ease of use in international transactions. The IMF has sold gold to various countries to increase its investment in government securities. The IMF also accepts gold as a payment for loans made to member countries with 85% majority approval from the IMF Executive Board.

Protection From Geopolitical Uncertainty

Gold is far less volatile than actual currency, which is subject to inflation and collapse. Russia’s invasion of Ukraine, China’s political tension with America, and other geopolitical and economic uncertainties prompted central banks to purchase 1,136 tons of gold in 2022. This is the largest purchase amount in 73 years. Through 2023, China, Turkey, Singapore, and India all bolstered reserves, with China alone increasing its reserves to 2,076 tons in a six-month period.

Gold prices show a positive correlation to geopolitical risk, even when controlling for financial market uncertainty. Some studies indicate that perceived geopolitical risk is the controlling factor, while others suggest that realized political risk has the largest impact. Regardless, it’s clear that gold becomes more valuable as the world becomes more uncertain.

Versatility for the Future

Gold can be swapped into any currency, which makes it an appealing option worldwide. Investors who choose gold aren’t beholden to a particular government to trade it, which leaves a world of possibilities for future use. Governments have historically used gold to boost currency reserves in times of financial uncertainty. It’s a universally accepted and appreciated asset.

Gold is also a valuable tool for diversifying financial portfolios. Diversity is the key to protecting financial assets in a volatile environment. Gold has long been respected as the go-to asset for diversification. Its historic significance gives it a stronger reputation than alternative commodities, such as lithium or diamonds. Major financial centers, including Shanghai, London, and New York, all maintain liquid markets with ample regulation for the trade of gold.

Maintaining Value

Gold has a long history of proven value. This strengthens and stabilizes central banks responsible for managing their countries’ currencies. National currencies are subject to variations based on the economy. Banks can print more money to prevent economic turmoil when currency becomes devalued. Since 2020, the United States has created almost 25% of all dollars in circulation, or nearly $5 trillion.

Printing this amount of money ultimately devalues it. Other countries lose confidence in the dollar when they see the United States printing so many of them. The United States must purchase debts from other countries to put this money into circulation, which makes those countries less confident in the United States economy. United States citizens also tend to devalue the dollar under these circumstances.

The devaluation of the dollar is a key reason why governments and investors often turn to gold. It’s impossible to create more gold out of thin air the way governments can create more paper money. This gives gold a greater intrinsic and natural value. Gold is a valuable precious metal in its own right, as it doesn’t corrode and is easy to melt, shape, and work with. Gold can be stored and exchanged in the form of coins, bars, or jewelry.

Manage Your Own Gold Assets

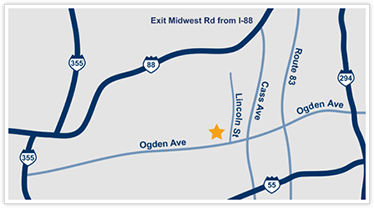

If you’re intrigued by the value and potential of gold investments, it’s never too soon to purchase some of this precious metal yourself. You can buy gold in the form of bullion or choose coins and jewelry that have their own added value beyond that of the metal itself. If you’re ready to sell your gold, you can easily turn it into cash. Americash Jewelry & Coin Buyer offers the highest gold prices in the Chicago area.

gold and black metal tool by Jingming Pan is licensed with Unsplash License